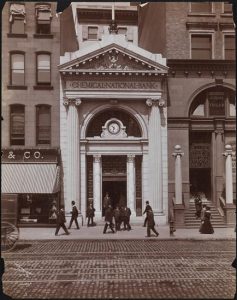

Case of De Frees Critten v The Chemical National Bank

[This is taken from David N. Carvalho’s Forty Centuries of Ink, originally published in 1904.]

[This is taken from David N. Carvalho’s Forty Centuries of Ink, originally published in 1904.]

FAMOUS CASE OF CRITTEN V. CHEMICAL NATIONAL BANK—STORY OF THE CASE INCLUDED IN THE OPINION OF THE COURT OF APPEALS AS WRITTEN BY JUSTICE EDGAR M. CULLEN—THE PINKERTON CASE OF “BECKER”—STORY OF HOW HE SECURED $20,000 THROUGH THE ALTERATION OF A $12 CHECK—BECKER’S COMMENTS ABOUT HIMSELF—A CRITICISM OF BECKER AND HIS WORK—NAMES OF SOME CASES IN WHICH CHEMICAL EVIDENCE WAS PRESENTED TO COURTS AND JURIES.

THE books contain no clearer or more forcible exposition of “Chemico-legal” ink, in its relationship to facts adduced from illustrated scientific testimony, than is to be found in the final opinion written by that eminent jurist Hon. Edgar M. Cullen on behalf of the majority of the Court of Appeals of the State of New York, in the case of De Frees Critten v. The Chemical National Bank. It was the author’s privilege to be the expert employed in the lower court about whose testimony Judge Cullen remarks (N. Y. Rep., 171, p. 223) “The alteration of the checks by Davis was established beyond contradiction,” and again, p. 227, “The skill of the criminal has kept pace with the advance in honest arts and a forgery may be made so skillfully as to deceive not only the bank but the drawer of the check as to the genuineness of his own signature.” The main facts are included in the portion of the opinion cited:

“The plaintiffs kept a large and active account with the defendant, and this action is to recover an alleged balance of a deposit due to them from the bank. The plaintiffs had in their employ a clerk named Davis. It was the duty of Davis to fill up the checks which it might be necessary for the plaintiffs to give in the course of business, to make corresponding entries in the stubs of the check book and present the checks so prepared to Mr. Critten, one of the plaintiffs, for signature, together with the bills in payment of which they were drawn. After signing a check Critten would place it and the bill in an envelope addressed to the proper party, seal the envelope and put it in the mailing drawer. During the period from September, 1897, to October, 1899, in twenty-four separate instances Davis abstracted one of the envelopes from the mailing drawer, opened it, obliterated by acids the name of the payee and the amount specified in the check, then made the check payable to cash and raised its amount, in the majority of cases, by the sum of $100. He would draw the money on the check so altered from the defendant bank, pay the bill for which the check was drawn in cash and appropriate the excess. On one occasion Davis did not collect the altered check from the defendant, but deposited it to his own credit in another bank. When a check was presented to Critten for signature the number of dollars for which it was drawn would be cut in the check by a punching instrument. When Davis altered a check he would punch a new figure in front of those already appearing in the check. The checks so altered by Davis were charged to the account of the plaintiff s, which was balanced every two months and the vouchers returned to them from the bank. To Davis himself the plaintiffs, as a rule, intrusted the verification of the bank balance. This work having in the absence of Davis been committed to another person, the forgeries were discovered and Davis was arrested and punished. It is the amount of these forged checks, over and above the sums for which they were originally drawn, that this action is brought to recover. The defendant pleaded payment and charged negligence on plaintiff’s part, both in the manner in which the checks were drawn and in the failure to discover the forgeries when the pass book was balanced and the vouchers surrendered. On the trial the alteration of the checks by Davis was established beyond contradiction and the substantial issue litigated was that of the plaintiff’s negligence. The referee rendered a short decision in favor of the plaintiffs in which he states as the ground of his decision that the plaintiffs were not negligent either in signing the checks as drawn by Davis or in failing to discover the forgeries at an earlier date than that at which they were made known to them.

“The relation existing between a bank and a depositor being that of debtor and creditor, the bank can justify a payment on the depositor’s account only upon the actual direction of the depositor. ‘The question arising on such paper (checks) between drawee and drawer, however, always relate to what the one has authorized the other to do. They are not questions of negligence or of liability to parties upon commercial paper, but are those of authority solely. The question of negligence cannot arise unless the depositor has in drawing his cheek left blanks unfilled, or by some affirmative act of negligence has facilitated the commission of a fraud by those into whose hands the check may come.’ (Crawford v. West Side Bank, 100 N. Y. 50.) Therefore, when the fraudulent alteration of the checks was proved, the liability of the bank for their amount was made out and it was incumbent upon the defendant to establish affirmatively negligence on the plaintiff’s part to relieve it from the consequences of its fault or misfortune in paying forged orders. Now, while the drawer of a check may be liable where he draws the instrument ill such ill incomplete state as to facilitate or invite fraudulent alterations, it is not the law that he is bound so to prepare the cheek that nobody else call successfully tamper with it. (Societe Generale v. Metropolitan Bank, 27 L. T. [N. S.] 849; Belknap v. National Bank of North America, 100 Mass. 380) In the present case the fraudulent alteration of the checks was not merely in the perforation of the additional figure, but in the obliteration of the written name of the payee and the substitution therefor of the word ‘Cash.’ Against this latter change of the instrument the plaintiffs could not have been expected to guard, and without that alteration it would have no way profited the criminal to raise the amount. . . .”

A Pinkerton case of international repute, best known as the “Becker” case, included the successful “raising” of a check by chemical means from $12 to $22,000. The criminal author of this stupendous fraud was Charles Becker, “king of forgers,” who as an all round imitator of any writing and manipulator of monetary instruments then stood at the head of his “profession.” Arrested and taken to San Francisco he was brought to trial. Two of his “pals” turned state’s evidence, and Becker was sentenced to a life term. Through an error on the part of the trial judge he secured a new trial on an appeal to the Supreme Court. The jury disagreed on a second trial, but on the third trial he was convicted. Becker pleaded for mercy, and as he was an old man and showed signs of physical break-down, the court was lenient with him. Seven years was his sentence.

After his incarceration in San Quetin prison, he described in one sentence how he had risen to the head of the craft of forgers. “A world of patience, a heap of time, and good inks,–that is the secret of my success in the profession.”

On completing his sentence, his reply to the question, “What was the underlying motive which induced you to forge?” was one word, “Vanity!”

The detailed facts which follow are from the “American Banker:”

“On December 2, 1895, a smooth-speaking man, under the name of A. H. Dean, hired an office in the Chronicle building at San Francisco, under the guise of a merchant broker, paid a month’s rent in advance, and on December 4 he went to the Bank of Nevada and opened an account with $2,500 cash, saying that his account would run from $2,000 to $30,000, and that he would want no accommodation. He manipulated the account so as to invite confidence, and on December 17 he deposited a check or draft of the Bank of Woodland, Cal., upon its correspondent, the Crocker-Woolworth Bank of San Francisco. The amount was paid to the credit of Dean, the check was sent through the clearing-house, and was paid by the Crocker-Woolworth Bank. The next day, the check having been cleared, Dean called and drew out $20,000, taking the cash in four bags of gold, the teller not having paper money convenient. He had a vehicle at the door, with his office boy inside as driver, and away he went. At the end of the month, when the Crocker-Woolworth Bank made returns to the Woodland Bank, it included the draft for $22,000. Here the fraud was discovered, and here the lesson to bankers of advising drafts received a new illustration. The Bank of Woodland had drawn no such draft, and the only one it had drawn which was not accounted for was one for twelve dollars, issued in favor of A. H. Holmes to an innocent-looking man, who, on December 9, called to ask how he could send twelve dollars to a distant friend, and whether it was better to send a money order or an express order. When he was told he could send it by bank draft, he seemed to have learned something new; supposed that he could not get a bank draft, and he took it, paying the fee. Here came back that innocent twelve-dollar draft, raised to $22,000, and on its way had cost somebody $20,000 in gold.

“The almost absolute perfection with which the draft had been forged had nearly defied the detection of even the microscope. In the body of the original $12 draft had been the words, ‘Twelve …….. Dollars.’ The forger, by the use of some chemical preparation, had erased the final letters ‘lve’ from the word ‘twelve,’ and had substituted the letters ‘nty-two,’ so that in place of the ‘twelve,’ is it appeared in the genuine draft, there was the word ‘twenty-two’ in the forged paper.

“In the space between the word ‘twenty-two’ and the word ‘dollars’ the forger inserted the word ‘thousand,’ so that in place of the draft reading ‘twelve dollars,’ as at first, it read ‘twenty-two thousand dollars,’ as changed.

“In the original $12 draft, the figures ‘1’ and ‘2’ and the character ‘$’ had been punched so that the combination read ‘$12.’ The forger had filled in these perforations with paper in such away that the part filled in looked exactly like the field of the paper. After having filled in the perforations, he had perforated the paper with the combination, ‘$22,000.’

“The dates, too, had been erased by the chemical process, and in their stead were dates which would make it appear that the paper bad been presented for payment within a reasonable length of time after it had been issued. The dates in the original draft, if left on the forged draft, would have been liable to arouse suspicion at the bank, for they would have shown that the holder had departed from custom in carrying, such a valuable paper more than a few days.

“That was the extent of the forgeries which had been made in the paper, the manner in which they had been made betrayed the hand of an expert forger. The interjected hand-writing was so nearly like that in the original paper that it took a great while to decide whether or not it was a forgery.

“In the places where letters had been erased by the use of chemicals the coloring of the paper had been restored, so that it was well-nigh impossible to detect a variance of the hue. It was the work of an artist, with pen, ink, chemicals, camel’s hair brush, water colors, paper pulp and a perforating machine. Moreover the crime was eighteen days old, and the forger might be in Japan or on his way to Europe. The Protective Committee of the American Bankers’ Association held a hurried consultation as soon as the news of the forgery reached New York, and orders were given to get this forger, regardless of expense—he was too dangerous a man to be at large. It was easier said than done; but the skill of the Pinkertons was aroused and the wires were made hot getting an accurate description of Dean from all who had seen him. Suspected bank criminals were shadowed night and day to see if they connected with any one answering the description, but patient, hard labor for nearly two months did not seem to promise much.”

Not satisfied with their success in San Francisco these same bank workers began a series of operations in Minneapolis and St. Paul, Minnesota. This information by chance reached the Pinkertons who laid a trap and captured two of the gang. Shortly afterward Becker on information furnished by them was also arrested, taken to California and after three separate trials as before stated, sent to San Quetin.

This triumph of the forger’s art, I examined in the city of San Francisco and, although it was not the first time I had been brought into contact with the work of Becker, was compelled to admit that this particular specimen was almost perfect and more nearly so with a single exception than any other which had come under my observation. Becker was a sort of genius in the juggling of bank checks. He knew the values of ink and the correct chemical to affect them. His paper mill was his mouth, in which to manufacture specially prepared pulp to fill in punch holes, which when ironed over, made it most difficult to detect even with a magnifying glass. He was able also to imitate water marks and could reproduce the most intricate designs. He says he has reformed.

During the last twenty years quite a number of cases have been tried in New York City and vicinity in which the question of inks was an all important one. The titles of a few not already referred to are given. herewith: Lawless-Flemming, Albinger Will, Phelan-Press Publishing Co., Ryold, Kerr-Southwick, N. Y. Dredging Co., Thorless-Nernst, Gekouski, Perkins, Bedell forgeries, Storey, Lyddy, Clarke, Woods, Baker, Trefethen, Dupont-Dubos, Schooley, Humphrey, Dietz-Allen, Carter, and Rineard-Bowers.